Top 5 Credit Card Processing Companies

Having trouble finding the right credit card processing company? Read below for the top 5 credit card processing companies.With most people using debit or credit cards for purchases and cash is slowly becoming less used. Accepting credit cards is essential but a problematic component to most businesses to survive. Credit card payments require the services of a credit card processing company, and with so many choices out there, it can be a daunting task to choose one that is right for you and your business. There are many things to consider, including the fees charged for both the consumer and the business and any transaction limits.

1. Square

Square is one of the more popular credit card processing options out there. This flexible and straightforward experience provides users with an easy-to-use platform. Square provides small businesses with flat transparent fees, and they provide all customers with a Chip Card Reader to swipe cards for free. Contactless and chipped card readers are available for purchase for $49, or you have the option of choosing to purchase a more customer-facing display that incorporates card swiping, taps, and dips for $799. The fee for the Square Register costs $799, but it is worth it for the user-friendly features.

Fees for Square are at 2.6% plus $.10 per transaction and keyed-in transactions costs 3.5% plus $.15. Over-the-phone transactions have a higher risk of fraud and therefore are subject to a higher fee. Online fees through online stores or invoices online are charged a 2.9% fee + $.30

Square accepts all major credit cards and many internationally issued cards. If you are looking for an easy setup with straightforward fees, Square is the best choice for you.

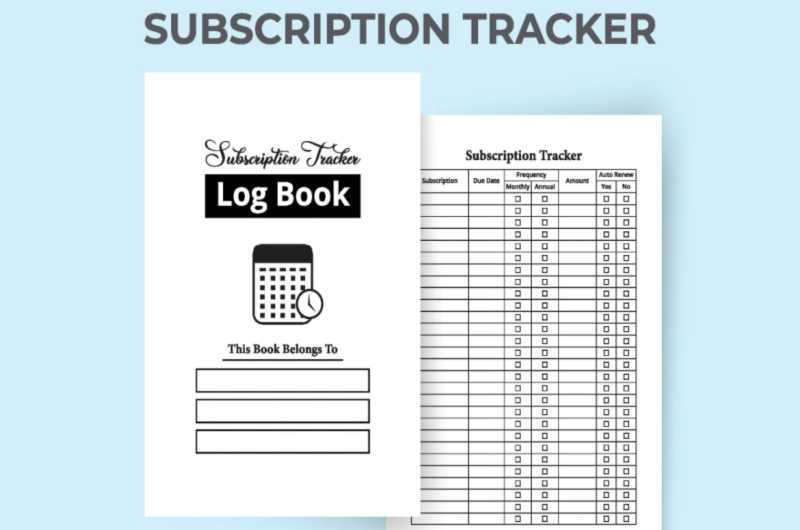

2. Stax

Stax by Fattmerchant is a perfect choice for many businesses, but it shines in the eCommerce space. Stax features a subscription pricing model, which tends to be great for many high-volume companies and offers reasonable starting fees of $99 a month, which is excellent for those small businesses. The monthly fee is exceptionally great for smaller businesses as they charge it instead of a percentage markup. Instead of charging a 2.6% + $.10 transaction fee, you would only pay the $.10 transaction fee. The 0% markup saves most business money which makes the monthly fee worth the price tag. Stax does not charge inflated fees for cards, not present transactions, or e-commerce transactions. Monthly fees are $99 a month, $.08 plus interchange for in-person transactions, and $.15 plus interchange for online transactions for businesses doing less than $5,000,000 a year.

For businesses over $5,000,000, Stax offers custom pricing with features built-in depending on the tier you choose. The Starter plan is only $49 a month and offers lite reporting, quick payment ACH processing (1% processing at a maximum of $10 per), and 24/7 support. The Growth is only $89 a month and offers everything in start plus Text2Pay, web-hosted payments, account reconciliation, including QuickBooks online, keep cards on file, and API key. The Pro has everything, including advanced dashboards and reporting, account updates, shopping cart and catalog management, recurring and scheduled payment options, and a dedicated account manager. Perfect for small or large volume businesses with customized plans to fit your needs, get started with Stax.

3. Helcim

Helcim is a perfect option for businesses that prefer no monthly fees and no long-term contracts. Helcim offers transparent fee schedules listed right on their website, so you know there are no hidden fees or getting stuck with a long-term contract challenging to find a way out. Helcim can offer low competitive rates by way of not accepting any high-risk businesses.

Helcim offers merchant services from mobile, in-person, and eCommerce payments. Using Helcim allows you to accept payments from anywhere globally with built-in payment options without the hassle of currency conversion.

Helcim offers one credit card terminal, the Helcim Card Reader. This device can manage all credit card processing needs from swiping, tap, or chips and can sync up with your laptop, smartphone, or tablet for easy tracking. The downside is it is operatable only by a rechargeable battery, so you must keep a charger handy.

The software offers product and service catalogs, unlimited invoice creation and access, inventory tracking, built-in credit and debit card process, custom drop-down fields, discount codes, auto tax calculations, email reminders, and a virtual terminal for cards- not-present sales.

Helcim fees work on a scale that is determined by the processing volume. The fees start at volumes less than $25,000 for in-person payments INT + 0.30% + $0.08 and keyed and online at INT plus 0.50% plus $0.25.

With its low fees and reasonable rates, Helcim is an excellent choice for small or seasonal businesses to accept credit cards.

4. Payment Depot

Payment depot uses a subscription or membership-based service with no application or set up fees. Payment Depot is known for its open and honest sales practices, along with its exceptional customer support.

Start with the Basic membership for $49 a month with a maximum volume of $25,000. The transaction fees are interchange plus $.10 a transaction, including a free gateway and virtual terminal payments. The Most Popular plan fees are $79 a month with a max volume of $75,000 and fees for interchange-plus $.10 a transaction. This service includes a free terminal or mobile card reader, and everything is included in basic. The premier plan is $99 and offers everything included in Most Popular plus data breach protection, a max volume of $150,000 a month, and fees that include interchange plus $07. The Unlimited plan consists of a dispute account manager for $199 a month with unlimited volumes, and the fee is interchange plus $.05 a transaction.

The benefit of going with Payment Depot is the fees are all combined into your monthly subscription without any surprise annual or hidden costs. Start with accepting credit card payments with Payment Depot.

5. Card Connect

Card connect allows businesses of all sizes to accept payments online safely and securely, in-person, or over the phone. Card Connect offers fantastic customer support, top-of-the-line data security, and seamless integrations that make it one of the top choices.

The proprietary security protects the consumer and the business owner with an extra layer of defense during the purchase process and in the event of a breach.

Card connect offers a browser-based point of sale, allowing you to do business from your computer, tablet, or mobile phone. They offer a countertop terminal that enables swipe, dip, and tap transactions with an easy-to-use interface.

Card Connect offers low payment processing rates making it an excellent choice for small business owners. Get started with Card Connect today.